Investor relations

About Stedin Group

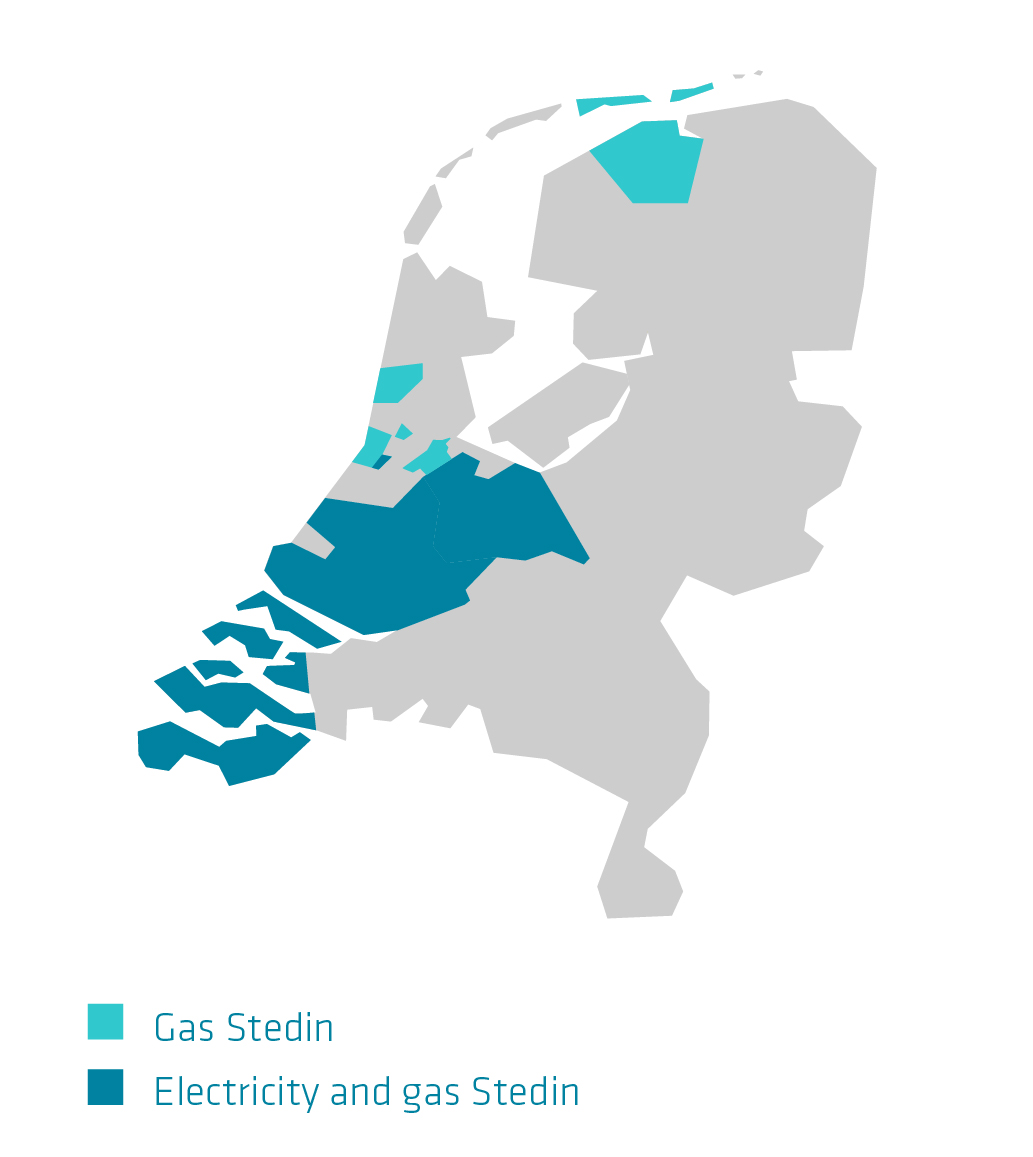

Stedin Group focuses on all activities relating to constructing, managing and maintaining energy grids. In addition, Stedin Group facilitates the energy market. Stedin Group consists of several business units: grid manager Stedin operates in the regulated market, while our infra partners NetVerder and DNWG carry out non-regulated activities. Together we ensure that all our customers have access to (sustainable) energy to live, work and do business.

How sustainable is Stedin Group?

As true ambassadors for the energy transition with an important role to play in society, we feel sustainable action speaks louder than words. We are modifying our network to accommodate new forms of energy, while taking a critical look at our own day-to-day activities. In addition to reducing our CO2 and particulate matter emissions, we are also committed to a circular approach to raw materials and equal opportunities for all. As a business with firm roots in broader society, our employees are also personally invested in new energy. But sustainable development is only possible if all parties in the chain contribute to this. That is why we ask our suppliers, by signing our supplier code of conduct, to make a demonstrable effort to comply with and promote our standards of conduct.

Our contributions to the sustainable development goals of the United Nations

Financial publications

Stedin Group was formed on 1 February 2017 as a result of the unbundling of Eneco Holding N.V. into an energy company (Eneco) and a network company (Stedin). Previous annual reports from Stedin Netbeheer B.V. can be found on the website below. The financial reports of Eneco Holding N.V. can also be consulted below.

Financing

Stedin Group has attracted funding and has several funding programs in place in order to attract capital in the future for different purposes and durations. Below the existing loans categorized are displayed as well as the details of the current financing facilities. Please click on one of the items below to find the requested financial information.

Loans & Bonds Outstanding

A Private Placement is a direct private offering of securities to a limited number of accredited institutional investors. The major outstanding private placements are listed below.

| US Private Placement 2017 | |

| Issuer | Stedin Holding N.V. |

| Arrangers |

n.a. |

| Amount |

EUR 200,000,000 |

| Ranking |

Senior Unsecured Notes |

| Maturity |

Several until 2027 |

| Schuldschein 2013 | |

| Issuer | Stedin Holding N.V. |

| Arrangers | Citibank |

| Amount | EUR 150,000,000 |

| Ranking | Senior Unsecured |

| Maturity | 2033 |

| US Private Placement 2007 | |

| Issuer | Stedin Holding N.V. |

| Arrangers |

Barclays Capital and RBS Greenwich Capital |

| Amount |

EUR 100,000,000 |

| Ranking |

Senior Unsecured Notes |

| Maturity |

Several until 2027 |

Issue history current bonds

October 2025 – Green bond issue under 2025 EMTN programme

On 23 October 2025 Stedin Groep issued a new bond for a total amount of EUR 500,000,000 nominal.

The bond has a 7 year tenor and will bear a coupon of 3.000%.

The notes are listed on Euronext Amsterdam (XS3218684101).

Final terms

February 2025 – Green bond issue under 2024 EMTN programme

On 4 February 2025 Stedin Groep issued a new bond for a total amount of EUR 500,000,000 nominal.

The bond has a 12 year tenor and will bear a coupon of 3.375%.

The notes are listed on Euronext Amsterdam (XS2997384776).

Final terms

June 2024 – Green bond issue under 2024 EMTN programme

On 11 June 2024 Stedin groep issued a new bond for a total amount of EUR 500,000,000 nominal.

The bond has a 7 year tenor and will bear a coupon of 3.625%.

The notes are listed on Euronext Amsterdam (XS2841150316).

Final terms

May 2022 – Green Bond issue under 2021 EMTN programme

May 24, Stedin Holding N.V. issued a new bond for a total amount of EUR 500,000,000.

The bond has a 8 year tenor and will bear a coupon of 2.375%.

The notes are listed on the Euronext Amsterdam (XS2487016250).

Final terms

November 2021 – Green Bond issue under 2021 EMTN programme

November 9, Stedin Holding N.V. issued a new bond for a total amount of EUR 500,000,000.

The bond has a 5 year tenor and will bear a coupon of 0.000%.

The notes are listed on the Euronext Amsterdam (XS2407985220).

Final terms

November 2019 – Green Bond issue under 2017 EMTN programme

November 11, 2019 Stedin Holding N.V. issued a new bond for a total amount of EUR 500,000,000.

The bond has a 10 year tenor and will bear a coupon of 0.500%.

The notes are listed on the Euronext Amsterdam (XS2079678400).

Final terms

September 2018 - Bond issue under 2017 EMTN programme

September 5, 2018 Stedin Holding N.V. issued a new bond for a total amount of EUR 500,000,000.

The bond has a 10 year tenor and will bear a coupon of 1.375%.

The notes are listed on the Euronext Amsterdam (XS1878266326).

Final terms

On March 23, 2021 Stedin Holding N.V. has issued a perpetual subordinated bond for a total nominal amount of EUR 500,000,000 at an issue price of 100% and an annual interest coupon of 1.50%. The bonds are subordinated to all other liabilities, though rank pari passu among other subordinated liabilities, of Stedin Group. The term of the bonds is infinite, where Stedin Group has the right to repay the bonds in 2027 and every year thereafter. Standard & Poor's has rated the instrument BBB-. The bonds are listed on Euronext Amsterdam (ISIN XS2314246526).

| Issuer | Stedin Holding N.V. |

| Amount | EUR 500,000,000 |

| Advising Banks |

Global Coordinators en Structuring Advisers: |

| ING Bank, NatWest Markets Joint Bookrunners en Dealer Managers: ING Bank, MUFG, NatWest Markets, Rabobank |

|

| Ranking |

Deeply subordinated; senior to share capital |

| Term |

Perpetual |

On January 14, 2026 Stedin Holding N.V. has issued a perpetual subordinated bond for a total nominal amount of EUR 500,000,000 at an issue price of 100% and an annual interest coupon of 4.25%. The bonds are subordinated to all other liabilities, though rank pari passu among other subordinated liabilities, of Stedin Group. The term of the bonds is infinite, where Stedin Group has the right to repay the bonds in 2036 and every year thereafter. Standard & Poor's has rated the instrument BBB-. The bonds are listed on Euronext Amsterdam (ISIN XS3276221531).

| Uitgever | Stedin Holding N.V. |

| Bedrag | EUR 500.000.000 |

| Begeleidende banken | BNP Paribas, ING Bank, NatWest Markets, Rabobank |

| Ranking | Diep achtergesteld; senior ten opzichte van aandelen kapitaal |

| Vervaldatum | Oneindig |

Bank Loans & Facilities

Revolving Credit Facility (RCF)

This committed Revolving Credit Facility has a maximum term until June 22, 2029, and will be used for general corporate purposes of Stedin Group.

| Borrower | Stedin Holding N.V. |

| Amount | EUR 800,000,000 |

| Coordinator |

Coöperatieve Rabobank U.A. |

| Facility agent | ABN AMRO Bank N.V. |

| Lead arrangers |

ABN AMRO Bank N.V., BNP Paribas, Coöperatieve Rabobank U.A., ING Bank N.V., Skandinaviska Enskilda Banken AB (Publ) en NatWest Markets N.V. |

| Maturity |

22 June 2029 |

Credit facility

| Borrower | Stedin Holding N.V. |

| Amount | EUR 250,000,000 |

| Lead arrangers | - |

| Maturity of availability period | 2028 |

| Issuer | Stedin Holding N.V. |

| Arrangers |

- |

| Amount | EUR 250,000,000 |

| Ranking |

Senior Unsecured |

| Maturity |

2035 |

Funding programmes & related documents

| Issuer |

Stedin Holding N.V. |

| Advising bank | ING Bank N.V. |

| Amount |

EUR 1,500,000,000 |

| Dealers | ABN AMRO |

|

BNP Paribas |

|

| Ranking |

Senior Unsecured Notes |

| Rating |

A-2 |

| Issue & Paying Agent |

Citibank, N.A., London Branch |

The Euro Medium Term Note programme allows Stedin Groep to issue notes with various maturities from 1 year typically up to 30 years in different currencies. The current EMTN programme size is EUR 5,000,000,000.

This last prospectus enclosed below is approved by the Dutch Authority for the Financial Markets (AFM) and is valid for 1 year following the date of approval.

| Issuer | Stedin Holding N.V. |

| Arrangers |

Coöperatieve Rabobank U.A. |

| Amount |

EUR 5,000,000,000 |

| Dealers | ABN AMRO Bank N.V. |

| BNP Paribas Coöperatieve Rabobank U.A. ING Bank N.V. Skandinaviska Enskilda Banken AB (Publ) NatWest Markets N.V |

|

| Ranking |

Senior Unsecured Notes |

Base prospectus 22 October 2025

Supplement to the base prospectus 30 January 2025

Supplement to the base prospectus 20 May 2022

Base prospectus 21 October 2021

Base prospectus 1 November 2019

Credit Ratings

Standard & Poor's issued a rating update on September 29, 2017 for Stedin Holding N.V. and the rating for Stedin Netbeheer B.V. The current ratings, shown below, are a reflection of the high degree of creditworthiness of Stedin Group and the positive attitude of Standard & Poor's regarding the positioning, strategy and management of the organization.

The solid cash flow, conservative financial strategy and the availability of committed credit facilities contribute to the current ratings.

| Description | Rating |

| Corporate Credit rating Stedin Holding N.V. | A-/Stable/A-2 |

| Corporate Credit rating Stedin Netbeheer B.V. | A-/Stable/ - - |

| Instrument | Rating | Rating date |

| EUR 500 million Perpetual Fixed Rate Reset Securities (Hybrid) | BBB- | March 22, 2021 |

S&P report – Ratings Direct 9 January 2026

S&P report - Ratings Direct 30 January 2025

S&P report - Ratings Direct 8 February 2024

Rating Bulletin – Rating Direct 14 February 2023

Rating Bulletin - Rating Direct 25 July 2022

S&P report - Ratings Direct 8 November 2021

S&P report - Ratings Direct 2 September 2020

S&P report - Ratings Direct 31 July 2019

S&P report - Ratings Direct 23 October 2018

S&P report - Ratings Direct 29 September 2017

S&P report - Ratings Direct 6 April 2017

Contact Investor Relations

Manager Treasury Stedin Group

Sebastiaan Weeda

E-mail: Sebastiaan.Weeda@stedingroep.nl